Have you ever wondered what separates a professional trader from a novice? No, it's not the size of their account or the number of monitors they have. Most binary options traders make the same fatal mistake: they try to predict the direction of the dollar’s movement based on indicators or chart patterns, forgetting that the reserve currency is only a reflection of much larger macroeconomic processes.

The dollar's true driver is the debt market, and its main indicator is the yield on 10-year US Treasury bonds (US10Y). In this review, we'll examine how movements in government bond interest rates influence the sentiment of large investors and why understanding this relationship gives binary options traders an advantage, allowing them to anticipate trend reversals in currency pairs before they appear on the chart in their trading terminal.

Content:

- Why do technical indicators often lie?

- What are bonds and how are they related to the dollar?

- The Golden Rule of Correlation

- How to use US10Y in binary options

- Conclusion

Why Do Technical Indicators Often Lie?

Many newbies to binary options trading often turn the chart of the asset being analyzed into a "Christmas tree," adorning it with dozens of indicators, ranging from the popular RSI and MACD to obscure "arrows," which, as practice shows, are mostly useless due to signal redrawing and can only boast of historical "results."

However, the problem lies not only in the excessive number of indicators themselves, but also in the fact that most of them are price-derived and are incapable of independently forecasting future price movements. All they can do is calculate their values based on embedded mathematical formulas, which results in delayed signals in receiving results.

This often leads to the price continuing to rise for a long time after the indicator shows "overbought," as major players continue to pour money into the market, pushing prices higher. Therefore, relying solely on indicators when trading is not advisable. Remember that they only capture the effect, not the cause, of price movements.

In the case of the US dollar, the bond market is the driver of its exchange rate movements against other currencies. While your favorite technical indicator is "drawing" a trading signal, US bond yields can start to change direction, signaling to professional traders that the currency pair's trend is about to reverse.

What are Bonds and How are They Related to the Dollar?

To understand how the dollar works, you need to stop viewing it as an abstract symbol in your broker's terminal. It's a fully-fledged investment instrument, just like stocks, for example.  US Treasuries are debt obligations of the American government. By purchasing them, an investor essentially lends money to the US economy at a certain interest rate, called the yield.

US Treasuries are debt obligations of the American government. By purchasing them, an investor essentially lends money to the US economy at a certain interest rate, called the yield.

When ten-year bond yields rise, this makes them extremely attractive to major players around the world. Since these bonds can only be purchased in dollars, investors begin buying up the US currency en masse. This sharp increase in demand leads to an increase in the US dollar's exchange rate against other global currencies.

Thus, thanks to rising bond yields, capital from around the world is flowing into dollars, and as long as the US10Y yield continues to rise, the American currency is receiving strong fundamental support. For a binary options trader, this means that trading against this movement, relying solely on technical analysis, becomes extremely risky.

The Golden Rule of Correlation

Nothing happens by chance in financial markets. Understanding intermarket relationships allows traders to see the overall picture of capital flows. The strongest correlation is observed between the yield on ten-year US bonds and the USD/JPY currency pair.

Since the Bank of Japan traditionally adheres to a low interest rate policy, monetary tightening in the US creates a significant yield gap between countries. As a result, investors around the world are actively selling yen to buy dollars and invest them in US bonds. For this reason, the US10Y and USDJPY charts often move almost in sync. This correlation is called a direct correlation.

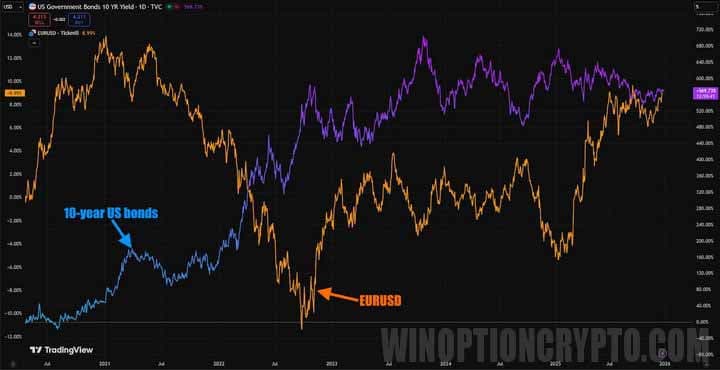

However, there are also examples of a very strong inverse correlation, such as between the US10Y, the EURUSD currency pair, and gold. Since owning the precious metal does not generate dividends or interest, it becomes a significantly less attractive means of preserving capital. Therefore, when the US10Y yield rises, investors sell gold and shift funds into bonds, leading to a decline in the price of this precious metal.

The euro is reacting in a similar way: the rise in the US dollar against the backdrop of rising bond yields is creating strong pressure on the single European currency, pushing its prices down.

For a binary options trader, this rule becomes a filter for decision-making. For example, if they see a call signal appear on the EURUSD chart, but the 10-year US bond yield continues to break new daily highs, the signal is likely false. This leads to the "golden rule": never trade against the direction of bond yields if your currency pair includes the US dollar.

How to Use US10Y in Binary Options

During the trading day, the best correlation between instruments is revealed during the New York trading session, which you can learn more about in the article " The Best Time to Trade Binary Options ." If you see a trade in the direction of bond yields at 6:00 – 7:00 New York time (13:00 – 14:00 GMT+2), the likelihood of it working out is higher than at any other time of day. This is the secret to day trading currency pairs that include the US dollar.

Typically, this window ends when the US stock market opens at 9:00 – 9:30 New York time (16:00 – 16:30 GMT+2), as this is when investors begin to shift their focus to stocks.

Conclusion

So, the number one secret to trading binary options on US dollar currency pairs is to pay attention to yield levels and their percentage changes throughout the day. If the yield on 10-year US bonds rises before the opening of the US session, it's worth looking for opportunities to open dollar call options against other currencies. If yields decline, consider opening dollar put options in the early hours of the New York trading session.

To leave a comment, you must register or log in to your account.